6 R implementation of the assignments 2019-2020

In this R tutorial you will implement the exercises from the assignment in R.

6.1 Assignment 1

The solution of the first assignment can be downloaded here.

6.1.1 Exercise 1

In the first exercise you computed a number of statistics for a distribution with cdf

\[ F_X(x) = \begin{cases} 0 & x < 0 \\ 1-0.5\cdot e^{-\beta\cdot x} & x \geq 0\end{cases}, \] for some \(\beta > 0\).

You can use the following function to simulate data from this distribution. Simulating from a given cdf will be covered in a later R tutorial.

simulate_assignment1 <- function(num_sim, beta) {

rexp(num_sim, rate = beta) * (runif(num_sim) > 0.5)

}

# this code simulates 10 observations from this distribution with beta = 0.5

simulate_assignment1(10, beta = 0.5) [1] 4.31338 2.72700 0.00000 0.00000 0.00000 4.74313 0.00000 0.09661 0.23204

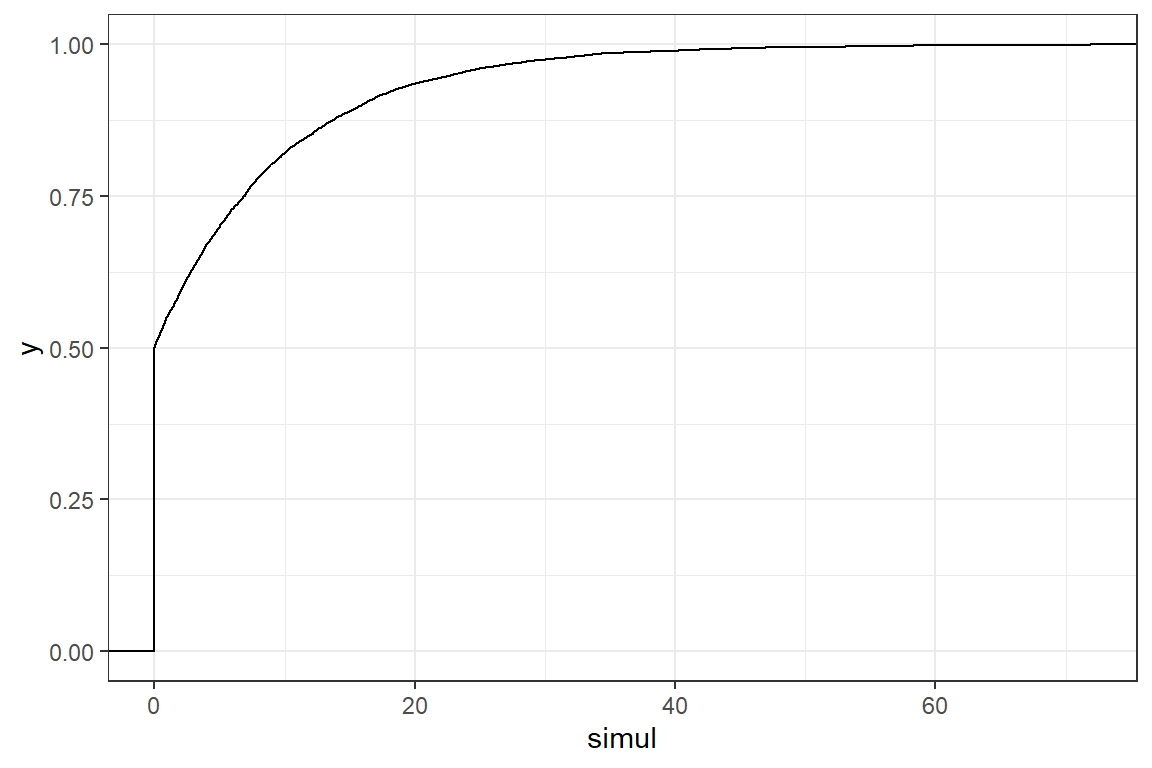

[10] 0.00000Choose a value for \(\beta\) and simulate 10.000 observations from this distribution. Using this simulation:

- Plot the empirical cdf of your simulation;

- Compute \(P(X = 0)\);

- Compute \(E(X)\);

- Compute \(\sigma(X) = \sqrt{E((X - E(X))^2)}\).

Compare your answers with the solution of the assignment.

# set the seed for replicability when working with random numbers

set.seed(1)

n <- 10000

beta = 0.1

simul <- simulate_assignment1(n, beta)

# @1

ggplot() +

theme_bw() +

stat_ecdf(aes(simul))

[1] 0.5018[1] 4.922[1] 5[1] 8.595[1] 8.66Next, we calculate \(E((X-30)_+)\). To calculate an expected value of the form \(E(g(X))\) from a simulation, we compute

\[ \widehat{E(g(X))} = \frac{1}{n}\sum_{i=1}^n g(x_i),\] where \(x_i\) are our simulated outcomes from the random variable \(X\).

In the case of the mean \(E(X)\), \(g(x) = x\), i.e. the identity function. We implement this function in R as

[1] 4.922You will now calculate the expected loss when there is a deductible of \(30\) using your simulated data.

Write a function

deductibletaking as inputx(a vector containing the loss amounts) andd(the deductible) and returning a vector \(y\) with \(y_i = (x_i-d)_+ = \max(x_i-d, 0)\);Test the function

deductiblethat you defined in the previous step. What is the output fordedutible(c(500, 200), 300). Is your function working as expected? A common mistake in implementing thedeductiblefunction is a misunderstanding of themaxfunction in R;

[1] 3[1] 2 3- Calculate \(E(X-30)_+\) for your simulated vector.

[1] 0.2519[1] 0.2489You will now calculate the remaining statistics from exercise 1.

- \(E(X \wedge 30)\)

- \(e_X(30)\)

- \(VaR_{0.95}(X)\)

6.2 Assignment 2

6.2.1 Exercise 2

You will solve a slightly adapted version of this exercise. Assume that the number of claims, \(N\), for an insurance portfolio follows a Poisson distribution with mean \(\lambda= 10\). The sizes of these claims are independent and follow a Gamma distribution with mean 1000 and variance 90000.

In this exercise you will compute various statistics related to the total loss.

- Create a single simulation for the aggregate loss \(S = X_1 + ... + X_N\).

set.seed(1)

lambda <- 10

mu <- 1000

sigmasq <- 90000;

# Simulate the number of claims from a Poisson distribution

N <- rpois(1, lambda)We have to simulate N losses from a gamma distribution with mean 1000 and variance 90000. When we check the documentation of rgamma we see that the distribution is parametrized by a shape and scale parameter.

In the details section of the documentation, you find: \[shape = a, scale = s, E(X) = a*s \text{ and } Var(X) = a*s^2.\] From this you can compute: \[scale = \frac{Var(X)}{E(X)} \text{ and } shape = \frac{E(X)}{scale}\]

You have now created a single simulation of \(S\). Using a for-loop, you can generate multiple simulations.

num_sim <- 1000

# create a vector for storing the result of the simulation

aggregated_loss <- rep(NA, num_sim)

for(i in 1:num_sim) {

# Add your code for a single simulation here

N <-

X <-

S <-

aggregated_loss[i] <- S

}You will now update the for-loop above to analyze the aggregated loss.

- Complete the for-loop and generate 1000 simulations of the aggregated loss;

- Use these simulations to compute the mean and standard deviation of the aggregated loss;

- Assume that the insurer imposes an ordinary deductible of 750.

Add the variables

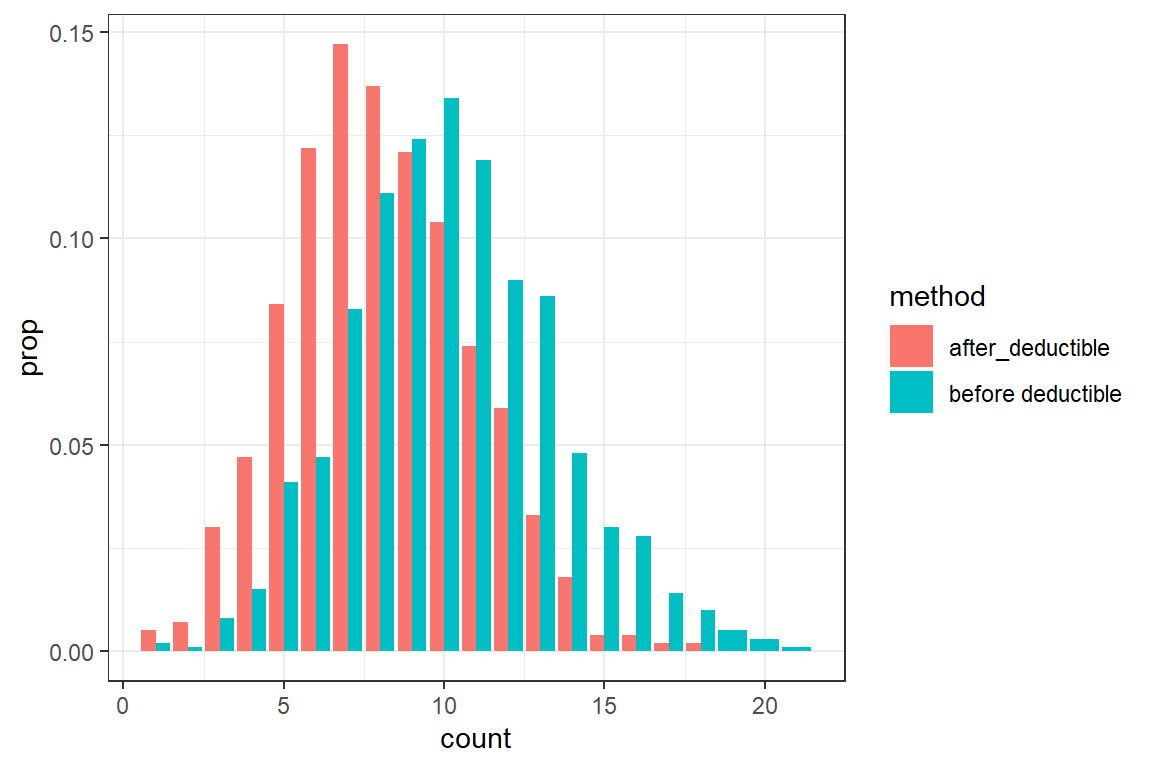

N_after_deductibleandaggregated_loss_deductiblein your simulation, which register the number of claims exceeding the deductible and the aggregate loss after imposing the deductible respectively; - Visualize the distribution of the number of claims before and after imposing the deductible;

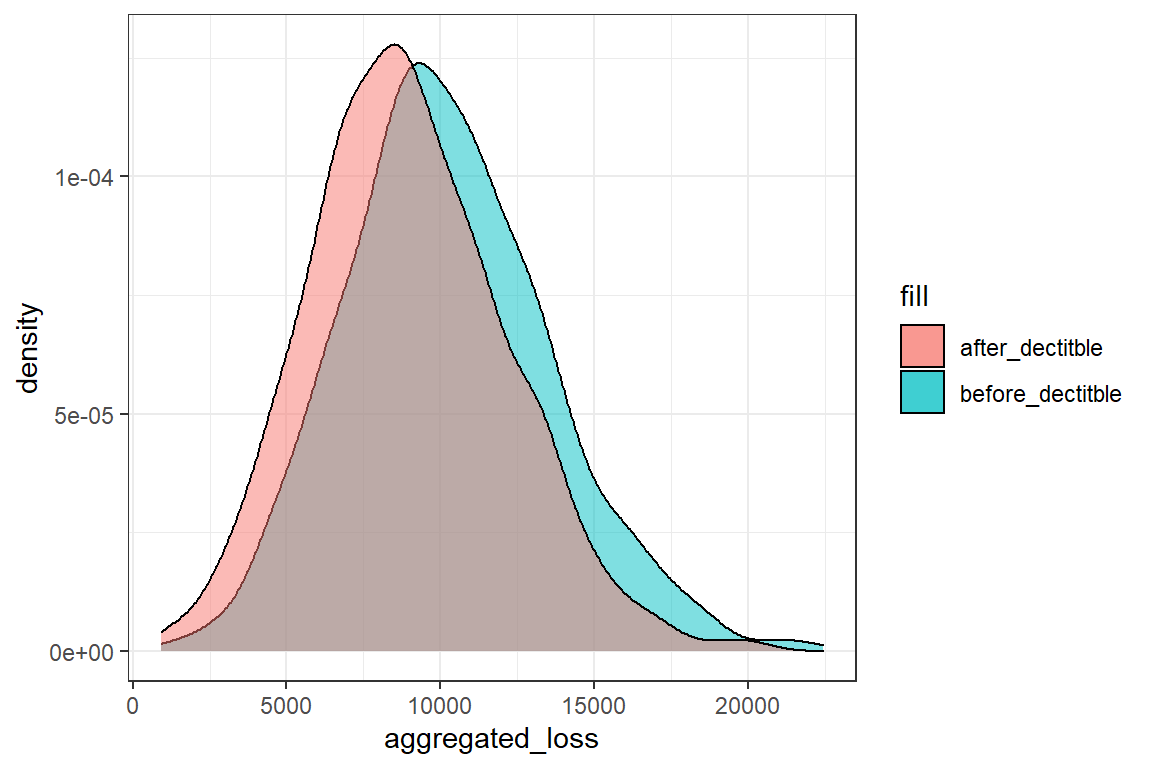

- Compare the density of the aggregate loss before and after imposing the deductible.

# @1

num_sim <- 1000

# create a vector for storing the result of the simulation

aggregated_loss <- rep(NA, num_sim)

for(i in 1:num_sim) {

# Add your code for a single simulation here

N <- rpois(1, lambda)

X <- rgamma(N, shape = shape, scale = scale)

S <- sum(X)

aggregated_loss[i] <- S

}

# @2

mean(aggregated_loss)[1] 9999[1] 3316# @3

num_sim <- 1000

# create a vector for storing the result of the simulation

deductible <- 750

aggregated_loss <- rep(NA, num_sim)

aggregated_loss_deductible <- rep(NA, num_sim)

N <- rep(NA, num_sim)

N_after_deductible <- rep(NA, num_sim)

for(i in 1:num_sim) {

# Add your code for a single simulation here

N[i] <- rpois(1, lambda)

X <- rgamma(N[i], shape = shape, scale = scale)

S <- sum(X)

aggregated_loss[i] <- S

N_after_deductible[i] <- sum(X > deductible)

aggregated_loss_deductible[i] <- sum(X[X > deductible])

}df <- rbind(data.frame(count = N, method = 'before deductible'),

data.frame(count = N_after_deductible, method = 'after_deductible'))

ggplot(df) +

theme_bw() +

geom_bar(aes(count, fill = method, y = ..prop.., group = method), position = position_dodge())

ggplot() +

theme_bw() +

geom_density(aes(aggregated_loss, fill = "before_dectitble"), alpha = .5) +

geom_density(aes(aggregated_loss_deductible, fill = "after_dectitble"), alpha = .5)